Valuing Data in Asset-Intensive Sectors

Asset management is underpinned by good data - so how do we value asset management data?

In this article, co-authored by Dr Sophia Elizabeth Fourie and Dr Jules Congalton, we break down why valuing asset management data is challenging, how updated ISO 55001:2024 standards are reframing data value and provide practical frameworks for valuing data.

The Case for Valuing Data

Data has become a foundational asset for organisations in utilities, manufacturing, mining, and public service sectors. As operational and strategic decisions increasingly depend on high-quality data, the ability to value and manage data effectively is no longer optional. Despite this growing reliance, many organisations still fail to treat data as a true asset. The reasons are structural: inconsistent valuation methods, fragmented data governance, and sector-specific constraints.

This article outlines the case for valuing data in asset-intensive sectors and identifies the structural challenges that make it difficult to do so. We examine methods for aligning valuation with the ISO 55000 standards and draw on sector-specific examples - from electricity and roading - to illustrate how data value can be surfaced, monetised, and protected. We also introduce the emerging practice of "insight packaging" as a way to extend data value beyond internal operations.

The paper is intended for asset managers, data leaders, and strategic decision-makers tasked with unlocking, justifying, or protecting the value of data within complex, asset-intensive environments.

The Challenge: Why Is Data Valuation So Difficult?

Most valuation techniques used for physical assets - cost-based, market-based, or income-based - fail to translate directly to data. Data's value is not inherent; it depends on the context of use, its timeliness, and its reliability. This makes universal frameworks difficult to apply across organisations, leading to inconsistent and often unreliable valuation practices. The following five factors underly the reason for this difficulty.

1. Lack of Standardised Valuation Methods

Traditional asset valuation approaches - such as cost, market, and income-based methods - don’t translate neatly to data. Unlike physical assets, data’s value is highly contextual, depending on its quality, timeliness, and how it is applied. This makes it difficult to establish a universal valuation framework that works across industries or even within a single organisation.

2. Data Management Complexities

The data lifecycle - collection, storage, use, and disposal - is often inconsistently managed. Poor governance can lead to data silos, duplication, and a gradual loss of utility. Interoperability is another major hurdle, especially for organisations dealing with legacy IT systems or a patchwork of software platforms.

3. Economic and Operational Impacts

Failing to value data correctly undermines its potential to optimise operations, reduce costs, and improve decision-making. For example, utilities that don’t harness real-time IoT data may face higher maintenance costs and more frequent service disruptions. In the public sector, inadequate data valuation can lead to inefficient resource allocation and regulatory non-compliance.

4. Regulatory and Stakeholder Pressures

Regulators and other stakeholders often require asset-intensive organisations to demonstrate accountability for all assets, including data. Robust asset registers and data-driven decision-making processes are now expected, while customers and investors demand that data is used responsibly and securely.

5. Sector-Specific Challenges

Public utilities often grapple with ageing infrastructure and limited budgets, making it essential to prioritise data investments that deliver the highest returns. Meanwhile, manufacturing and mining face the challenge of integrating operational data with business intelligence systems across complex asset portfolios.

Why Valuation Matters

Data valuation provides the mechanism through which data becomes visible in strategic decision-making. Without a formal valuation approach, data remains a background utility - used, but rarely accounted for. As regulatory scrutiny intensifies and digital investments expand, organisations need clearer methods to quantify, justify, and defend the role of data in both operational and long-term value creation. The following factors outline why data valuation is important.

· Strategic Asset Management

Aligning data with ISO 55000 standards ensures that it is managed as a strategic asset - one that supports performance, risk, and cost optimisation across the asset lifecycle. This framing shifts data from an IT concern to a board-level responsibility.

· Economic Efficiency

Robust valuation enables business cases for data-related investments by demonstrating clear return on value. Organisations can better allocate resources toward data acquisition, analytics capabilities, and system upgrades when benefits are defined in financial terms.

· Enhanced Decision-Making

Valuation frameworks improve decision quality by making data contributions explicit. Whether in planning, maintenance, or renewal phases, decision-makers can see the impact of data on downtime reduction, risk mitigation, or service outcomes.

· Sector-Specific Applications

Valuation allows sector leaders to link data directly to public or commercial outcomes. In public utilities, this includes regulatory compliance and rate justification. In mining and manufacturing, it supports predictive maintenance and efficiency analytics.

· Sustainability Goals

When operational and environmental data are valued correctly, they support carbon reporting, energy optimisation, and resource use transparency - key pillars of sustainable asset management.

Ultimately, data valuation is not just a technical exercise - it is a governance imperative. By quantifying the value that data delivers across cost, performance, and risk domains, organisations can align their data management practices with their strategic ambitions. It is this alignment that transforms data into an instrument of competitive advantage.

Evolving Standards: ISO 55001:2024 and the New Pillars of Value

The ISO 55000 family of standards has long provided the foundation for asset management best practices. Recent updates to ISO 55001 (2024) mark a shift toward broader, more integrated definitions of value - ones that explicitly recognise the role of data in driving outcomes across the asset lifecycle.

The latest standards identify four primary drivers of value that apply directly to data:

· Cost: Minimise the expense of acquiring, storing, managing, and securing data, while maximising its contribution to return on investment.

· Risk: Reduce exposure to data-related risks such as security breaches, data loss, obsolescence, or non-compliance with regulatory mandates.

· Opportunities: Use data to identify future potential - whether in operational optimisation, innovation, market positioning, or strategic partnerships.

· Performance: Improve asset lifecycle decisions, operational resilience, and service delivery through timely and accurate data.

This expanded framing affirms that data is not merely an input to asset management - it is a dimension of value in its own right. By adopting the updated ISO view, organisations can move beyond compliance and leverage data to shape strategy, anticipate disruption, and deliver sustained value across multiple stakeholders.

Valuation Methods: Choosing the Right Lens

Valuing data is not a one-size-fits-all process. The appropriate method depends on context: what the organisation is trying to achieve, which risks it must manage, and how value is defined - financially, operationally, or societally. This section outlines several valuation methods and explores how they can be adapted or combined to support a more robust, purpose-driven approach.

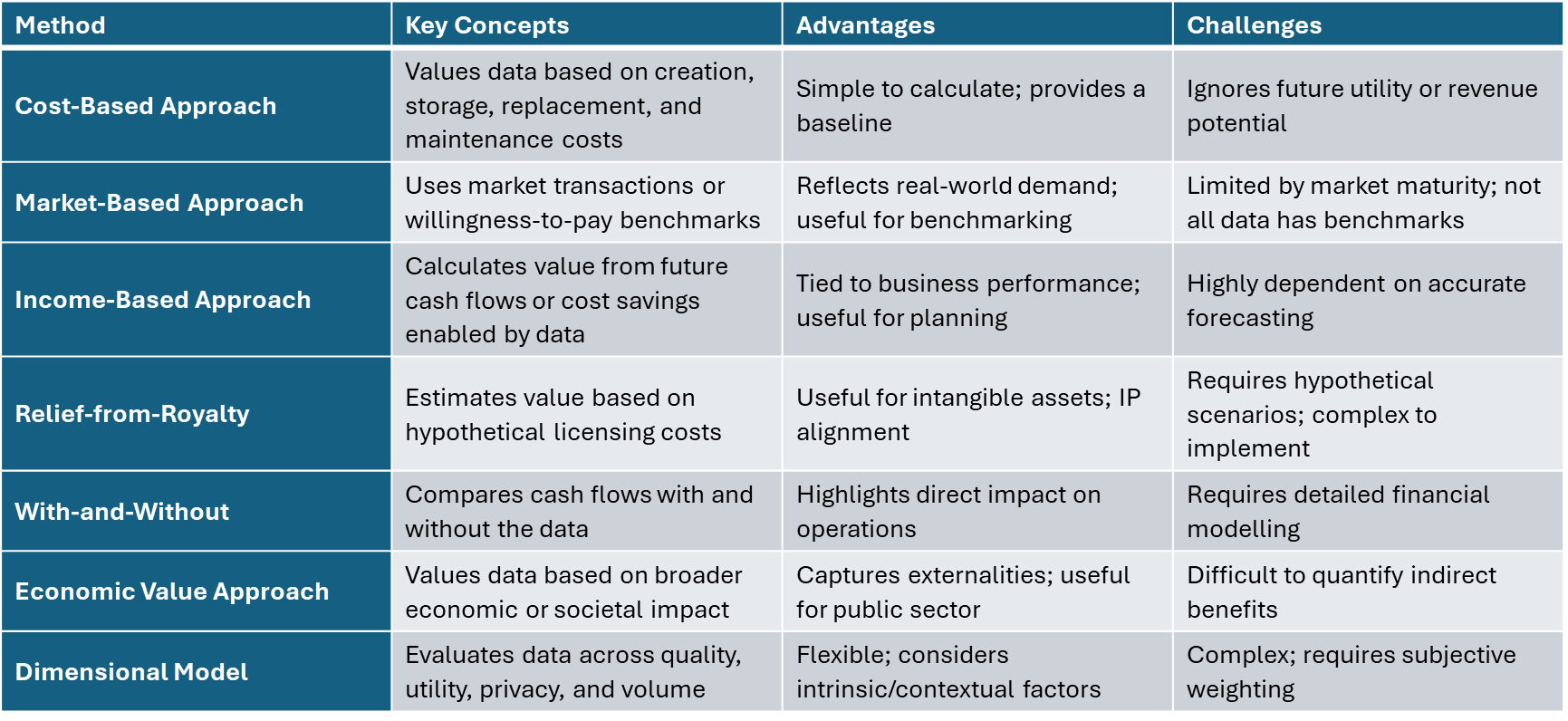

Comparion of data valuation methods

Key Insights:

The choice of method depends on the purpose - financial reporting, strategic decision-making, or regulatory compliance.

Hybrid models are emerging as best practice, combining elements from multiple approaches to capture both intrinsic and extrinsic value.

Challenges include subjectivity in assumptions, lack of standardisation, and evolving regulatory frameworks.

A data value framework is required to understand what data is critical to support an organisation’s asset management strategy and therefore the value of the data.

Another Approach to the Value of Data: Insight Packaging

Insight packaging offers an alternative route to unlock the value of data - particularly for organisations that cannot or should not expose raw datasets. By structuring internal data into advisory outputs, benchmarks, or decision-support tools, firms can extract strategic and economic value while maintaining data confidentiality. This method positions data as a relationship asset: something that can generate influence, foster partnerships, and support monetisation through design rather than disclosure.

Successful insight packaging typically involves:

Audience Clarity: Identifying who will use the insight and what decisions it needs to support.

Format Discipline: Choosing a format - dashboard, index, benchmark, forecast - that aligns with the user’s context.

Interpretive Design: Ensuring the insight is framed to deliver meaning, not just numbers.

Confidentiality Preservation: Stripping out raw data while preserving analytical credibility.

Strategic Intent: Using insights to support partnerships, advisory models, or policy influence - not just internal reporting.

When executed well, insight packaging transforms internal data into a strategic asset that is both defensible and deployable. It allows organisations to influence decisions, strengthen credibility, and explore new value pathways - without ever needing to trade or expose sensitive datasets.

Example from The New Zealand Electricity Sector

The electricity sector in New Zealand illustrates how data valuation frameworks can directly inform infrastructure investment, regulatory approval, and risk mitigation strategies. In this case, data does not simply support reporting - it is used to monetise risk, benchmark performance, and defend long-term capital plans. At the centre of this approach is a shift in how value is defined. Data-driven indicators such as Value of Lost Load (VoLL), interruption frequency, and outage costs are tied to economic outcomes. These metrics are used not just to justify individual investments, but to quantify the cost of inaction.

This section presents how data can be valued by electricity network operators in New Zealand as it using figures that reflect cost avoidance, performance gains, and resilience outcomes.

Cost consequences are a significant consideration and therefore an Economic Value Approach can be used to value data. For instance, the Commerce Commission approved Transpower’s $5.9 billion five-year investment plan - a 44% increase from the previous period - to replace ageing infrastructure. This decision balanced the immediate impact of higher consumer prices against the long-term savings from avoiding outages. Delaying these investments results in significantly higher future costs, underscoring the importance of valuing the data that supports such critical decision-making.

The Value of Lost Load (VoLL) is another critical metric. Transpower’s research estimates outage costs at $142,632 per MWh for 10-minute industrial interruptions and $7,169 per MWh for residential outages. These figures are essential for cost-benefit analyses of grid resilience projects. Without an understanding of VoLL, network investment decisions risk prioritising less critical assets. Applying a With-and-Without approach can help determine the value of the data, as the likely loss of value from sub-optimal decisons can be quantified in terms of the value of lost load.

Performance metrics also support the valuation of data-driven decisions. Unison, for instance, reports a System Average Interruption Duration Index (SAIDI) of 195.5 minutes per customer annually - well below the industry average of 286.4 minutes. Its System Average Interruption Frequency Index (SAIFI) is also notably lower. These improvements yield an estimated $18.7 million per year in avoided outage costs. A With-and-Without approach can help assess the value of the data used to identify the optimal maintenance and investments decisions. This approach uses the value of the SAIDI and SAIFI impact to value the data used to identify optimal investments, as without this data, these SAID and SAIFI improvemetns would not occur.

Finally, risk valuation is becoming an essential component of data valuation. For instance, Transpower allocated $240 million to elevate substations above flood levels—a proactive investment far less costly than the estimated $430 million recovery bill from a major flood. Without data on event likelihood and potential economic impact, justifying such expenditures becomes challenging.

In summary, data-driven insights underpin infrastructure investments in the electricity sector, enabling decisions that balance cost, risk, performance, and opportunity to maximise value for providers and consumers. The high cost of poor decisions resulting from missing critical data determines its intrinsic value.

Example from Managing Roads in England

Highways England places significant emphasis on valuing its data by linking it directly to key value drivers in infrastructure asset management. These drivers include roading costs, performance improvements, and risk mitigation. By quantifying these factors, Highways England demonstrates the tangible benefits that data delivers across its network.

A notable example is its economic valuation of data, which found that every £1 invested yields £2.70 in economic value for stakeholders such as logistics companies, commuters, and transport hubs. Geospatial data, valued at £3.2 billion, underpins traffic management, incident response, and network capacity planning. Traffic flow data (£2.3 billion) helps optimise road usage and reduce congestion, while road information (£2.2 billion) enhances safety through accident alerts and real-time updates.

For asset valuation, Highways England uses the Depreciated Replacement Cost (DRC) method to determine the fair value of infrastructure assets, ensuring investment decisions align with lifecycle costs and ongoing service potential across pavements, structures, technology assets, and land.

The connection between data and investment outcomes is evident in multiple areas. Routine maintenance extends asset lifespans and avoids costly major interventions. During RIS2 (2020–2025), the focus on maintenance aligned with performance goals while reducing long-term expenses. Smart motorway investments delivered a benefit-cost ratio (BCR) of 2.4, generating £6.3 billion in benefits from £2.6 billion in costs and significantly improving traffic flow and reducing congestion.

Performance metrics have also improved through data-driven decision-making. Geospatial data supports traffic management and enhances journey reliability, reducing delays and improving user satisfaction. Junction improvements under RIS2 achieved a BCR of 2.3, illustrating the value of targeted investments. Highways England’s analytical platform integrates asset condition analysis with traffic modelling, enabling prioritisation of investments that maximise network performance.

Risk management benefits from targeted safety and environmental initiatives. Safety upgrades are projected to reduce fatalities and serious injuries by over 50%, resulting in substantial societal savings from lower trauma-related costs. Environmental measures help reduce carbon emissions and support net-zero targets, proactively managing climate change risks to the road network.

Integrated decision-making is facilitated by Highways England’s analytical platform, which ensures consistency across all areas of expenditure. Economic assessments combine monetised impacts, such as BCRs, with non-monetised factors like environmental benefits. Data-driven insights are used to develop a balanced portfolio, prioritising investments that deliver high value for money while effectively mitigating risks.

By valuing its data and linking it to infrastructure outcomes, Highways England ensures that its data investment decisions are evidence-based, cost-efficient, and aligned with long-term strategic objectives.

Conclusion: Turning Data into Value

Data valuation is becoming a defining capability for asset-intensive organisations. As digital infrastructure expands and stakeholder expectations intensify, the ability to assign value to data will determine whether it is seen as a cost centre or leveraged as a strategic asset.

This paper has demonstrated that valuation is not merely about assigning a number - it is about making data visible in governance, investable in capital planning, and actionable in risk decisions. Whether through formal frameworks, hybrid models, or insight packaging, data must be treated as an asset with lifecycle relevance and systemic impact.

Organisations that integrate data valuation into their asset management system will be positioned to achieve superior performance, strengthen resilience, and deliver transparent value to stakeholders. Those that delay will struggle to justify decisions, attract investment, or meet regulatory and societal demands in an increasingly data-dependent future.